stop on quote versus stop limit on quote

Stop Loss Limit Etrade changed the stop loss function some time ago. The stock is volatile so you enter a stop price of 105 and a limit price of 110.

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

A stop-on-quote order is an order to buy or sell a security when its price surpasses a particular point limiting your loss or.

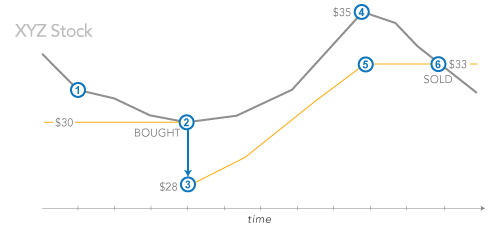

. But this time youre also going to place a limit at the minimum price youre willing to sell the shares lets say 95. Stop limit orders are slightly more complicated. Lets use this same premise with you holding shares of XYZ at 100 and setting a stop order at 98.

Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. Since a market order has no conditions as to what price it may be executed at it is typically filled immediately. To protect a portion of their gains 15 the trader places a sell order to stop at 170.

Whereas once a stop order triggers at the specified price it will be filled at the prevailing price in the marketwhich means that it could be executed at a price significantly different than the stop price. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. The stop order is an order type that immediately sends a market order when the market hits the set stop loss level.

A buy stop order executes at a stop price that is above the current market price. A limit order will then be working at or better than the limit price you entered. The stop price is a price that is above the market price of the stock whereas the limit price is the highest price that a trader is willing to pay per share.

The stop price and the limit price. Lets consider a trader who bought FB for 155 and it is now trading at 185. A stop order on the other hand is used to limit losses.

When the stop price is triggered the limit order is sent to the exchange. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. When the stock reaches your stop price your brokerage will place a limit order.

Your limit price must be lower than or equal to your stop price when selling and must also be within 9 per cent of your stop price. If the price drops at the stop price there is an assumption that the price will continue to fall. If it jumps up 245 it will then have a new price of 24019 that will be the limit sell price and you would have gotten a.

With a stop limit order traders are guaranteed that if they receive an execution it will. For example if John intends to buy ABC Limited stocks that are valued at 50 and are expected to go. Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better.

It enables an investor to have some downside. If you use a stop-limit order once the stop level is reached a limit order. If the price of Acme shares declined to 90 but the best available transaction price at this point is only 8875 the order will not be filled since that level is.

The stop-limit order can help address this scenario. This would mean that our portfolio will immediately sell Stock A for any. For example a sell stop limit order with a stop price of 300 may have a limit price of 250.

This frees the investor from monitoring prices and allows the investor to lock in profits. It is a pending order to at the stop price or lower. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order.

A limit order is an order to buy or sell a set number of shares at a specified price or better. The limit order will fill as long as the shares stay below 110. Our stop price would be 8 while our limit price would be 775.

Stop on quote orders can be used to limit losses or buy stocks only. A limit order guarantees price but not an execution. Bad thing about SLOQ is if there isnt a good BID support you may take a huge loss from what you set your price at as the computer works its way down the BID side selling your stock off.

For example if the trader in the previous scenario enters a stop-limit order at 25 with a limit of 2450 the order triggers when the price. It enables an investor to have some downside. In our first example you were sold out at 90 because once.

Once the shares reach 105 the stop order will execute and trigger the limit order. The trade will only execute at the set price or better. If the price of Stock A hits 8 or below the order would convert to a limit order set at 775.

Account holders will set two prices with a stop limit order. You use a sell stop to set a price lower than the market price to minimize loss. In contrast a sell stop order executes at a stop price below the current market price.

A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order. If the currency or security for trading reaches the stop price the stop order becomes a market order. It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far.

So once ADA hits 230 it will put a limit sell order that will trail the highest price by 2. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. The stop price and the limit price for a stop-limit order do not have to be the same price.

If you want 100 shares the order will begin filling at 105 but will stop if the stock quickly shoots over 110. For example a sell stop limit order with a stop price of 300 may have a limit price of 250. The stop price and the limit price for a stop-limit order do not have to be the same price.

So if ADA hits 230 and then drops to 229 it will not sell. Limit orders are executed automatically as soon as there is an opportunity to trade at the limit price or better. By selling at the stop.

Limit is an important distinction that can significantly change the outcome of your order.

If You Can T Stop Thinking About It Buy It Quotes For Small Businesses Hannah Wills A Shopping Quotes Funny Shopping Quotes Fashion Quotes Inspirational

Potentially Protect A Stock Position Against A Market Drop Learn More

Perfectionism Vs Progression Feel Good Quotes Investing Trading Quotes

Potentially Protect A Stock Position Against A Market Drop Learn More

Stop Loss Vs Stop Limit Order What S The Difference

Limit Order Vs Stop Order Difference And Comparison Diffen

19 Powerful Quotes That Motivate You To Start Powerful Quotes Inspirational Quotes Motivation Work Quotes

Trading Faqs Order Types Fidelity

Copy Forex Forexfactory Index Trading สอน เทรด Forex Copy Trading Forex สอน เทรด 007 Forexfactory Index Forex Trading Trading Quotes Trend Trading

How To Turn Boring Text Into A Typographic Masterpiece Powerful Quotes Quotes Writing Prompts

Price Action Secrets Forex Trading Quotes Trading Quotes Cryptocurrency Trading

Stop Limit Order Example Free Guide With Charts

Trading Up Close Stop And Stop Limit Orders Youtube

Quotes Givers Need To Set Limits Because Takers Rarely Do Encouragement Quotes Motivational Quotes Work Quotes

Age Is No Barrier It S A Limitation You Put On Your Mind Age Difference Quotes Aging Quotes Age Difference Relationship

The Only Person That Can Stop You From Reaching Your Goals Is You Don T Limit Yourself With Negativ Quotes To Live By Positive Mental Attitude Positive Quotes

Love This Super Super Sweet Belive In Everything You Do There Is No Limit To Stop Always Achive Before You Quit Neymar Jr Neymar Neymar Memes